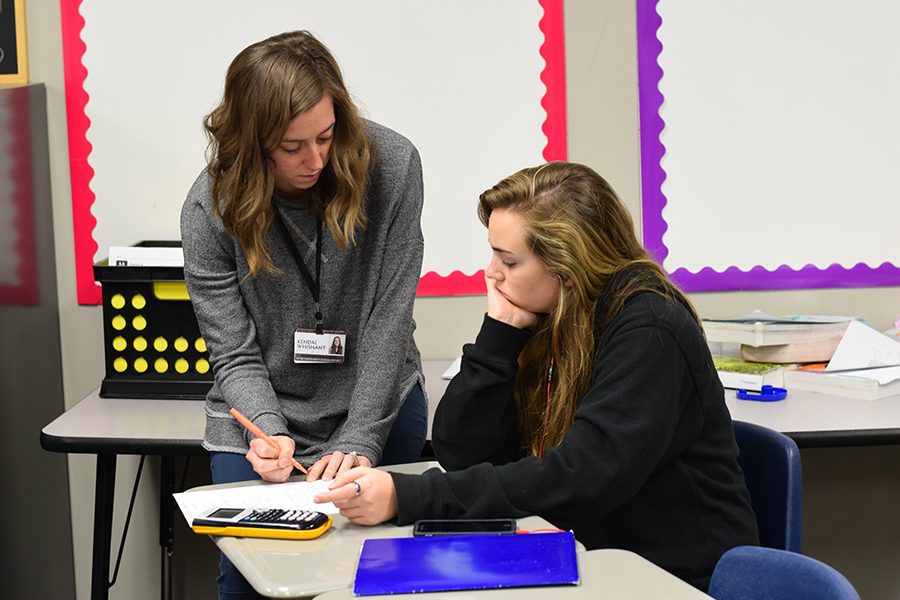

photo credit: Mashawn Rolfe

Teacher’s aid \\ Mrs. Kendal Whisnant helps junior Angela Talley with her assignment in her fifth period Algebra II class.

Life with debt

School staff discusses college debt

February 15, 2017

College debt; almost everyone has heard of it. Many people have it, and many more have thought of what it would be like to have it. Lots of people think that people who have college debt tend to have about $20,000 to $50,000 or that they have to follow an elaborate set of directions to make a payment, but that’s not always the case.

Coach Matt Langer, the world history teacher and freshman basketball coach, attended the University of Texas in Dallas and currently has about $10,000 in college debt from loans. He thinks he can pay them in about five to six years. He used the loans for his tuition and books and wishes ‘it was gone’.

My college loans are an overwhelming amount of money that never seems to decrease. I try to pay a little more than what is actually due so it will not take me as long to pay it back.

— Mrs. Whisnant

“[If I could,] I would pay more for classes out of [my] pocket,” Langer said.

Mrs. Kendal Whisnant, the PAP/Regular Algebra II teacher, attended Stephen F. Austin State University with scholarships and has already paid off her loans. She, however, still has debt, but not college debt.

“[It’s an] overwhelming amount of money that never seems to be decreasing,” Mrs. Whisnant said.

Ms. Whisnant has a little tip she uses to pay her debt.

“I try to pay a little more than what is actually due so it will not take me as long to pay it back,” Mrs. Whisnant said.

Mrs. Amy Tietjen, the PAP/ Regular chemistry teacher, has already paid off her loans and currently does not have any debt. She attended Abilene Christian University and was granted both academic and athletic scholarships. Her loans were also used to pay for her tuition and books.

“I am very glad that I moved away from home and went to college. I am glad that I got to experience dorm life. I was able to grow and survive on my own without my parents I had a plan and was able to get through college with some loans, and I also had a plan to get them paid off quickly, Planning is the key,” Mrs. Tietjen said.

Mrs. Emily Whittle, one of our school counselors, does not have any debt currently and was granted a scholarship to play basketball at ACU. Her tuition and room and board were paid for, but had to pay for summer school.

“Usually a scholarship committee will evaluate all the applications and decide on a winner based on the criteria given,” Mrs. Whittle said, “Some scholarships are given in the form of a check to the student and others are applied directly to the tuition and fees at the school.”

If you want to graduate debt free, Mrs. Whittle highly recommends you to complete the Free Application for Federal Student Aid.

“Completing the FAFSA is the first thing student need to do to help finance college,” Mrs. Whittle said, “Students need to look for ways to save money such as buying used books, eating on campus instead of going out to eat or taking a course at a community college over the summer. “